Table of contents

AARRR pirate metrics

If you don't run AARRR, you'll keep "scaling" the wrong thing. You'll buy more leads when activation is the real problem. You'll celebrate trial signups while churn quietly erases them. You'll change pricing without knowing whether you're fixing revenue or just accelerating cancellations.

The payoff of AARRR is simple: you get one growth story instead of five disconnected dashboards. It makes your growth predictable because you can see which step is throttling outcomes.

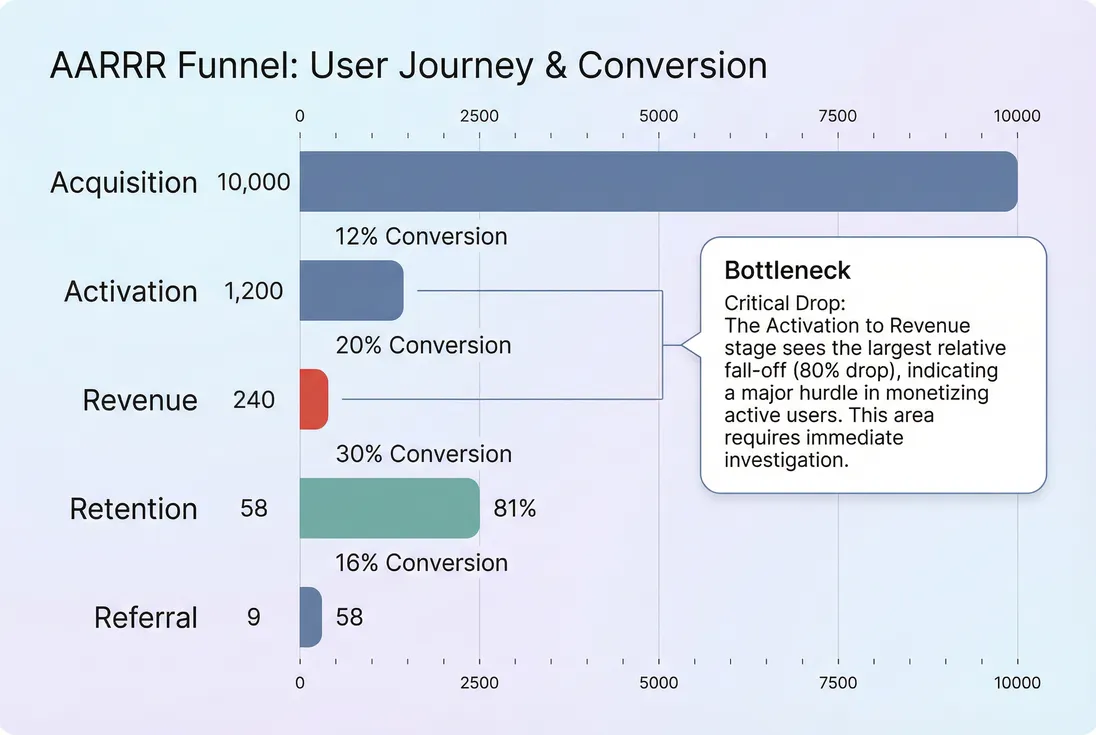

AARRR is a funnel framework that tracks how strangers become customers—and how customers stick, pay, and refer others. The stages are Acquisition, Activation, Revenue, Retention, Referral.

What AARRR is really for

AARRR is not a "growth metrics list." It's a way to answer four operator questions:

- Where is the bottleneck right now?

- Is the bottleneck quality or quantity?

- Which lever fixes it fastest (product, pricing, sales, lifecycle)?

- Did the fix improve downstream results, or just move numbers upstream?

When AARRR works, it creates focus. When it fails, it becomes a bunch of uncorrelated rates that teams argue about.

The founder's perspective

Your job is not to "improve activation." Your job is to pick the one constraint that makes revenue more predictable in 30–90 days, then push it hard.

Where founders mess it up

Most AARRR implementations break in predictable ways:

- They optimize Acquisition before Activation. That's paying to find out your onboarding is confusing.

- They define Activation as a shallow click. Then "activation improvements" don't change retention.

- They treat Revenue as first purchase only. In SaaS, revenue is a stream. Expansion and contraction are the real game.

- They don't segment. Blended conversion rates hide the truth. One channel is great, another is garbage, and the average lies to you.

- They ignore time. Funnels aren't only drop-offs; they're also delays. Time-to-value and sales cycle length matter as much as conversion rate.

If you want one rule: a stage metric is only useful if it predicts the next stage. If it doesn't, it's a vanity metric.

How to calculate AARRR (without overthinking)

AARRR is a chain of ratios. You don't need fancy math, but you do need consistency in definitions and time windows.

The core idea is that your end result is the product of the steps:

You can (and should) measure each stage as a conversion rate:

Two practical notes:

- Use the same entity across the funnel when possible. Visitor → account → paid account → retained paid account. If you switch units (users vs accounts) midstream, you'll confuse everyone.

- Pick a time window that matches your motion. PLG might use day 0–7 activation and day 30 retention. Sales-led might use lead → SQL → closed-won and then 90-day retention.

Question 1: are we buying the right acquisition?

Acquisition is not "traffic." Acquisition is qualified entry into your funnel.

What to measure

At minimum:

- Volume: signups, leads, demos (whatever "entry" means for you)

- Efficiency: CAC (Customer Acquisition Cost), CPL (Cost Per Lead) if you run paid

- Conversion: visitor-to-signup, lead-to-customer, demo-to-close (Lead-to-Customer Rate), Win Rate))

A simple acquisition conversion example:

What changes when it moves

- If acquisition volume rises but activation and retention don't, you are importing low-fit users (or your promise is wrong).

- If acquisition efficiency improves (lower CAC) while conversion stays flat, you probably improved targeting or channel mix.

- If acquisition conversion improves but retention worsens, you likely made the top-of-funnel promise broader than the product can satisfy.

What to do next (practical)

- Segment by channel and persona. "Paid search" and "partner referrals" are different businesses. Treat them that way.

- Instrument first-touch and intent. You need to know what the buyer thought they were buying.

- Don't scale spend until activation and early retention are stable. Otherwise CAC becomes a tax on chaos.

The founder's perspective

If you can't name your best acquisition channel and explain why it produces better retention, you don't have a channel—you have a hope.

Question 2: what counts as activation here?

Activation is the most abused stage in AARRR because it's tempting to make it easy.

Activation means: the user reached first value. Not "created an account." Not "clicked around."

Define activation like an operator

A good activation event has three properties:

- It happens early.

- It correlates strongly with retention.

- It reflects real value delivered.

Common activation definitions:

- "Invited a teammate" (collaboration products)

- "Connected a data source" (analytics, ETL, billing integrations)

- "Published first project" (creator tools)

- "Completed onboarding checklist" (only if checklist items are value, not busywork)

If you need help designing it, start with Time to Value (TTV) and Onboarding Completion Rate. Those are usually your activation root causes.

Activation rate formula:

Benchmarks (use carefully)

| Motion | "Good" activation signal | Typical time window | Notes |

|---|---|---|---|

| PLG self-serve | 15–40% | 0–7 days | Wide range; depends on complexity |

| Trial-to-paid B2B | 20–60% | trial length | Activation must predict purchase |

| Sales-led | 60–90% | post-implementation | Activation may be onboarding completion |

Benchmarks are only useful if you tie them to downstream outcomes. The only benchmark that matters is: activated users retain.

What to do next (practical)

- Run an activation cohort: activation rate by signup week, then track 30/60/90-day retention by "activated vs not."

- Reduce steps to first value. Cut fields, cut configuration, cut internal dependencies.

- Stop shipping features that don't improve activation or retention. Your roadmap is probably full of coping mechanisms.

The founder's perspective

Activation is where "growth" becomes a product problem. If activation is weak, marketing is not your constraint—your product is.

Question 3: are we monetizing the right behavior?

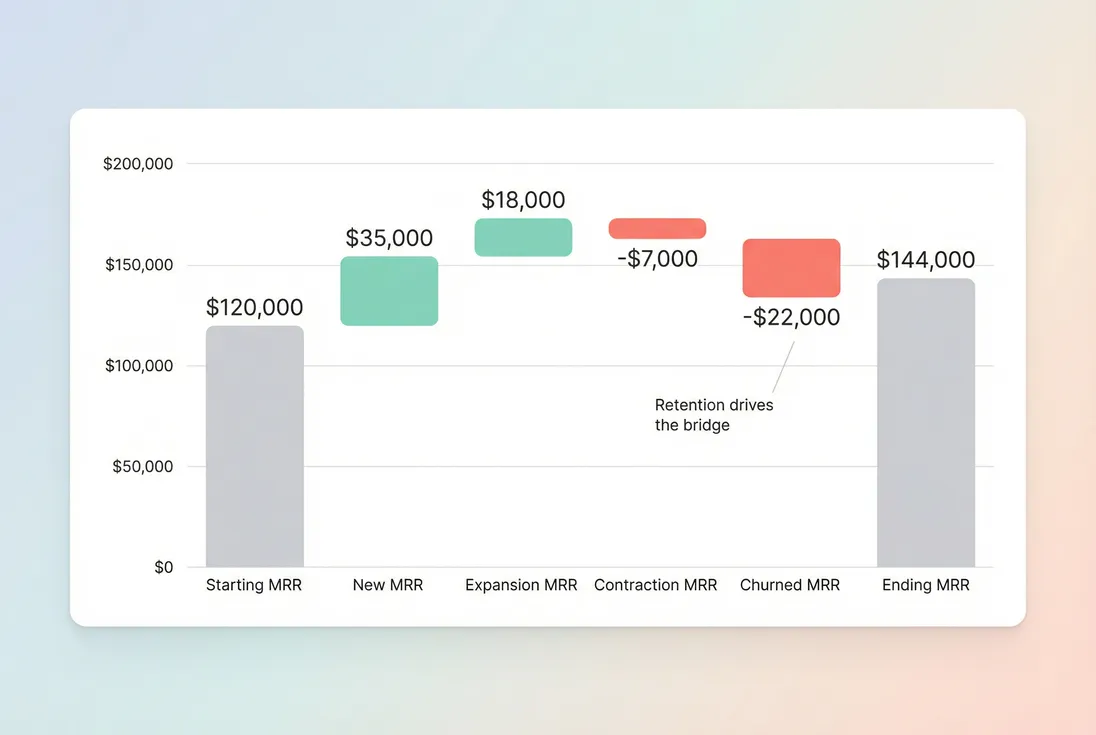

Revenue in AARRR is not "we got a credit card once." For SaaS, revenue is a recurring outcome: who pays, how much, how soon, and whether they expand.

What to measure

You need three layers:

- Conversion to paid

- Trial-to-paid

- Lead-to-customer

- Initial monetization

- Revenue quality over time

A clean, operator-friendly revenue conversion rate:

If your sales cycle is longer, measure conversion over a longer window (for example, activated in month 1 → paid by month 2 or 3).

What changes when it moves

- If paid conversion rises but retention drops, you might be discounting too hard or selling customers you can't serve. Read Discounts in SaaS if this is happening.

- If ARPA rises but acquisition falls, you may have pushed pricing above willingness-to-pay for your core segment.

- If MRR grows but net MRR churn stays ugly, you are "running faster to stand still." Track Net MRR Churn Rate alongside new MRR.

What to do next (practical)

- Tie monetization to value metrics. If pricing isn't aligned to the behavior that creates value, you'll either cap expansion or trigger churn.

- Watch payback, not just conversion. If CAC rises faster than LTV, you're not scaling—you're compounding risk. Use CAC Payback Period and LTV (Customer Lifetime Value).

- Separate "new MRR" from "net new MRR." New sales don't matter if churn eats them.

If you use GrowPanel, this is exactly why you want MRR movements and net MRR churn in the same weekly operating review, with filters by plan and acquisition source where possible.

Question 4: will customers still be here?

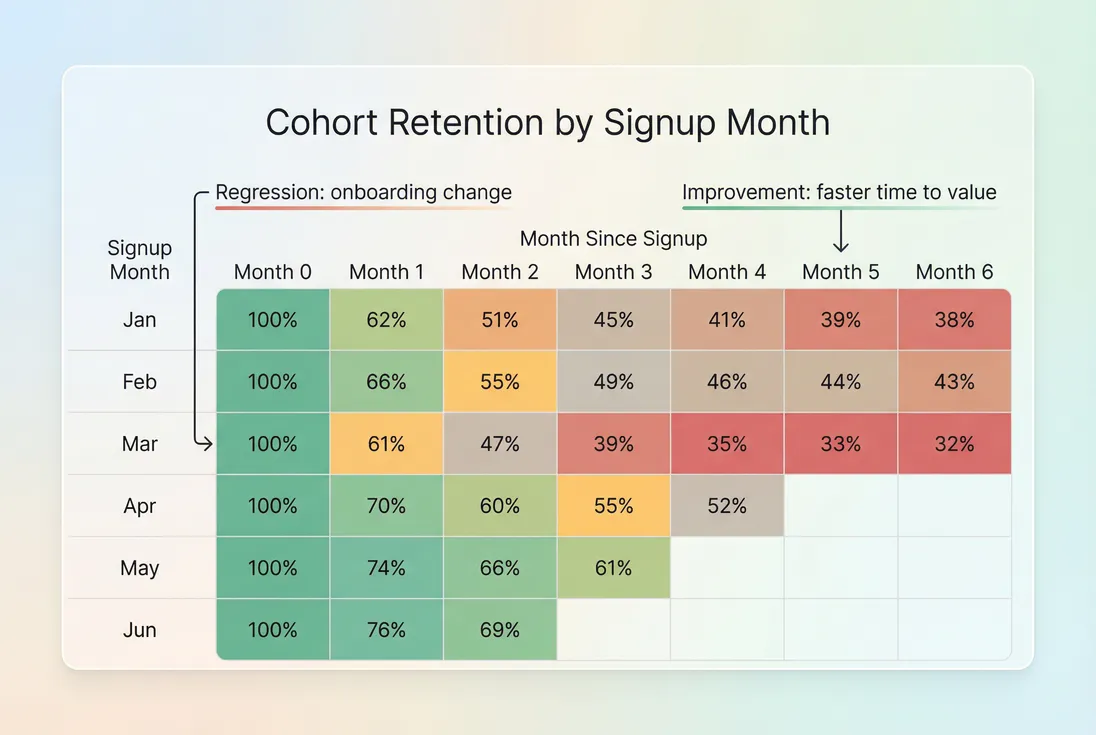

Retention is where SaaS companies are made or broken. If retention is weak, every other stage is a temporary illusion.

There are two retention lenses:

- Logo retention: do customers stay? (see Logo Churn)

- Revenue retention: does revenue stay and expand? (see NRR (Net Revenue Retention) and GRR (Gross Revenue Retention))

Retention rate:

Churn is the inverse lens. For practical work, you'll spend a lot of time on:

What changes when it moves

- If logo churn worsens but revenue retention is stable, you're losing small accounts. That may be acceptable—or it may be a warning that your low-end onboarding is failing.

- If GRR drops, you have a core value problem (product, onboarding, support, reliability, wrong ICP).

- If NRR drops while GRR stays fine, expansion is failing (packaging, pricing, seat growth, usage-based design, or customer success motion).

The only retention analysis that matters: cohorts

Blended retention hides changes in customer quality and changes in product experience. You need cohorts. Start with Cohort Analysis.

What to do next (practical)

- Pick a retention promise and operationalize it. Example: "Customers get first value in 24 hours." Then measure it and staff it.

- Do churn reason analysis, but don't worship it. Use Churn Reason Analysis to generate hypotheses, then validate with cohort data.

- Fix involuntary churn first. It's the fastest win and the least controversial. Then tackle voluntary churn with onboarding, product gaps, and ICP tightening.

If you use GrowPanel, this is where retention and cohorts earn their keep. You're not looking for "a number." You're looking for which cohorts improved, which regressed, and why.

Question 5: are referrals actually a growth lever?

Referral is last in AARRR because it's usually not the first bottleneck. Most SaaS companies don't have a true viral loop early. They have word-of-mouth, which is different.

Referral means: existing users reliably bring in new qualified users.

What to measure

Pick one that matches your motion:

- Referral participation rate: percent of active customers who referred at least one new lead this period

- Referral conversion quality: do referred leads activate and retain better than other channels?

- Time-to-referral: how long after activation does referral happen?

Simple referral participation rate:

What changes when it moves

- If referral rises while acquisition spend stays flat, you may have found a compounding channel.

- If referral leads convert but don't retain, your customers might be referring the wrong persona (or your positioning is off).

- If referral requires discounts or heavy incentives, you might be buying referrals, not earning them.

What to do next (practical)

- Earn referrals through outcomes, not gimmicks. Referral happens after value and confidence.

- Target referral moments. "Share report," "invite teammate," "export deliverable," "publish link." Build referral into workflows that already happen.

- Measure referred cohort retention. If referred users aren't stickier, your referral loop is not a loop—it's a one-time spike.

The founder's perspective

Referrals don't fix a churny product. They amplify whatever you already are. Make sure what you are is worth amplifying.

AARRR tradeoffs you should be explicit about

Founders get stuck because improving one stage can hurt another. That's normal. The mistake is pretending it won't happen.

Here are the common tradeoffs:

| Lever | Helps | Often hurts | How to manage |

|---|---|---|---|

| Broader positioning | Acquisition | Activation, retention | Segment by persona; tighten ICP later |

| Shorter onboarding | Activation | Support load | Add guardrails, better defaults |

| Heavier discounting | Revenue conversion | Retention, expansion | Use time-boxed discounts; track cohorts |

| Higher pricing | ARPA, cash | Acquisition, activation | Pair with packaging and clearer value |

| Aggressive sales | New MRR | Logo churn | Enforce qualification; measure GRR |

If you're not tracking downstream effects, you'll "improve" AARRR in ways that lower LTV and raise CAC.

What to watch vs ignore

Watch these because they drive decisions:

- Activation rate by channel

- Paid conversion from activated

- Net revenue retention (or net MRR churn if you operate in MRR terms)

- Cohort retention trends after major product or pricing changes

- CAC payback tied to retention, not just top-of-funnel conversion

Ignore (or demote) these until you've earned them:

- Raw traffic growth

- Social followers

- App opens without a value event

- Any blended average that hides segment differences

If you want one weekly review: AARRR by segment with one bottleneck called out and one experiment shipped.

Your next steps (do this in order)

- Define your activation event and prove it predicts retention (cohort it).

- Build a single AARRR scorecard by segment (channel, plan, persona).

- Pick the bottleneck closest to revenue and run 2–4 focused experiments.

- Review MRR movements and retention together so "growth" can't hide from churn.

- Only then scale acquisition spend.

If you do this consistently, AARRR stops being pirate cosplay and becomes what it's supposed to be: a blunt operating system for growth.

Frequently asked questions

It is useful if you treat it like a bottleneck finder, not a dashboard decoration. AARRR forces you to quantify where customers drop and where revenue is actually created. If you cannot point to the single worst stage this month, you are guessing.

Optimize the first stage that is both measurably broken and close to revenue. In most SaaS, that is activation or early retention, not acquisition. More traffic on top of a leaky product just increases support load and churn, not growth.

There is no universal number because activation depends on your time to value and ICP clarity. Early B2B products can look ‘low' but still win if activated users retain and expand. Your benchmark is the activation rate of users who later retain.

Tie every stage metric to a downstream business outcome: retained customers and retained revenue. If a metric does not predict retention or revenue, demote it. Watch conversion by cohort and by channel, not blended totals that hide low-quality growth.

They overlap in expansion and contraction. ‘Revenue' is not just first purchase; it is how much customers are worth over time. Use net revenue retention thinking to connect monetization to retention. If revenue rises but retention falls, you have a pricing or fit problem.