Table of contents

Freemium model

Freemium is one of the fastest ways to grow signups—and one of the fastest ways to accidentally fund a large non-paying customer base with real cash. The business impact isn't "more users." It's whether free users reliably become profitable paid customers without blowing up support, infrastructure costs, or pricing power.

A freemium model is a go-to-market and packaging strategy where your product has a permanent free plan and you monetize by upgrading a subset of free users to paid plans (often self-serve), typically aligned with Product-Led Growth.

Why founders choose freemium

Freemium is not "free trial, but longer." It's a bet that:

- Self-serve adoption can scale without a proportional increase in sales effort.

- The product markets itself through usage, sharing, or embedded workflows.

- Marginal cost per free user is low enough that you can wait for upgrades.

- Upgrade triggers (limits, collaboration, security, scale) appear naturally as usage grows.

Freemium tends to work best when value is continuous (not a one-time evaluation), and the free plan still solves a real problem. It tends to fail when the product's main value only shows up at "full power" (better suited to Free Trial) or when costs scale directly with free usage (data processing, support-heavy onboarding, compliance work).

The Founder's perspective

Freemium is a financing decision. You're financing customer acquisition with your own infrastructure, support time, and opportunity cost. If you can't explain how free users become paid users—and when—you're just adding burn. Tie freemium performance back to Burn Rate and Runway, not just signup growth.

What you should measure (and ignore)

A freemium plan generates a lot of "activity" that doesn't matter. The job is to isolate the handful of measures that drive revenue outcomes.

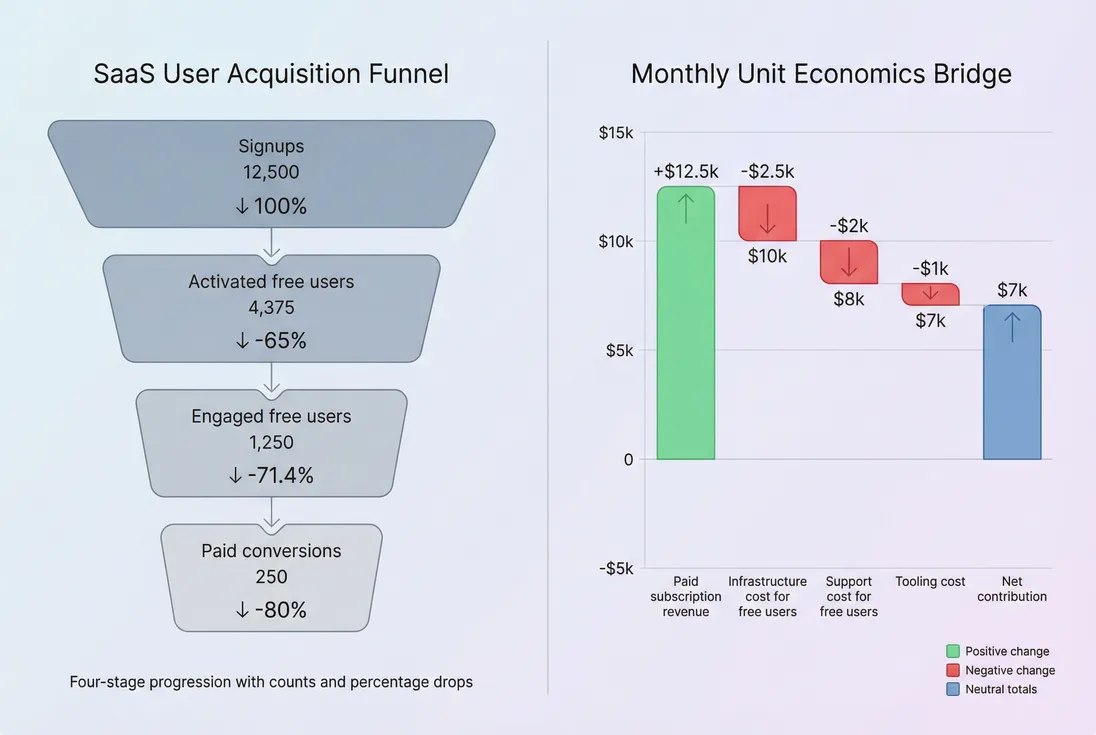

The core freemium funnel

At minimum, track these stages separately:

- Signups (top-of-funnel volume)

- Activated free users (experienced initial value)

- Engaged free users (repeat usage; indicates habit)

- Paid conversions (upgrades)

- Paid retention and expansion (durability and upside)

In many products, the biggest lever is not more signups; it's moving more users from "signed up" to "activated." Use Onboarding Completion Rate and Time to Value (TTV) to find why activation lags.

A simple conversion definition

Founders often debate "What counts as conversion?" Don't overcomplicate it. For freemium, the practical metric is:

Why active free users (not all historical free accounts)? Because it makes the metric actionable. If a user hasn't touched the product in 90 days, they're not "in your upgrade funnel." They're in your database.

Also track conversion from activated users:

This is usually the metric that tells you whether your packaging and paywall make sense.

Revenue metrics that matter after conversion

Once users convert, freemium should improve (not weaken) the quality of revenue. Tie conversions to:

- MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue)

- ARPA (Average Revenue Per Account) and ASP (Average Selling Price)

- Logo Churn and Customer Churn Rate

- NRR (Net Revenue Retention) and GRR (Gross Revenue Retention)

If freemium produces lots of low-ARPA customers with high churn, you may be scaling the wrong segment.

When freemium is economically viable

Freemium viability comes down to unit economics: the expected profit created by a free user must exceed the cost of acquiring and serving them.

A useful "back of the envelope" expectation:

To estimate Paid LTV, you can start with a simple approximation based on gross margin and churn (refine later with cohorts):

Use LTV (Customer Lifetime Value) for deeper treatment, and pair it with CAC (Customer Acquisition Cost) or CAC Payback Period if you spend meaningfully to acquire free users.

The cost-to-serve trap

Freemium often breaks because founders undercount "cost to serve," especially:

- Infrastructure tied to usage (storage, compute, API calls)

- Support and success time (even "light touch" adds up at scale)

- Abuse, spam, and edge-case maintenance work

- Billing/admin overhead created by lots of tiny accounts (even if free)

You don't need perfect cost accounting, but you do need directional truth. Start with COGS (Cost of Goods Sold) and Gross Margin. If you can't explain how gross margin behaves as free users grow, you're flying blind.

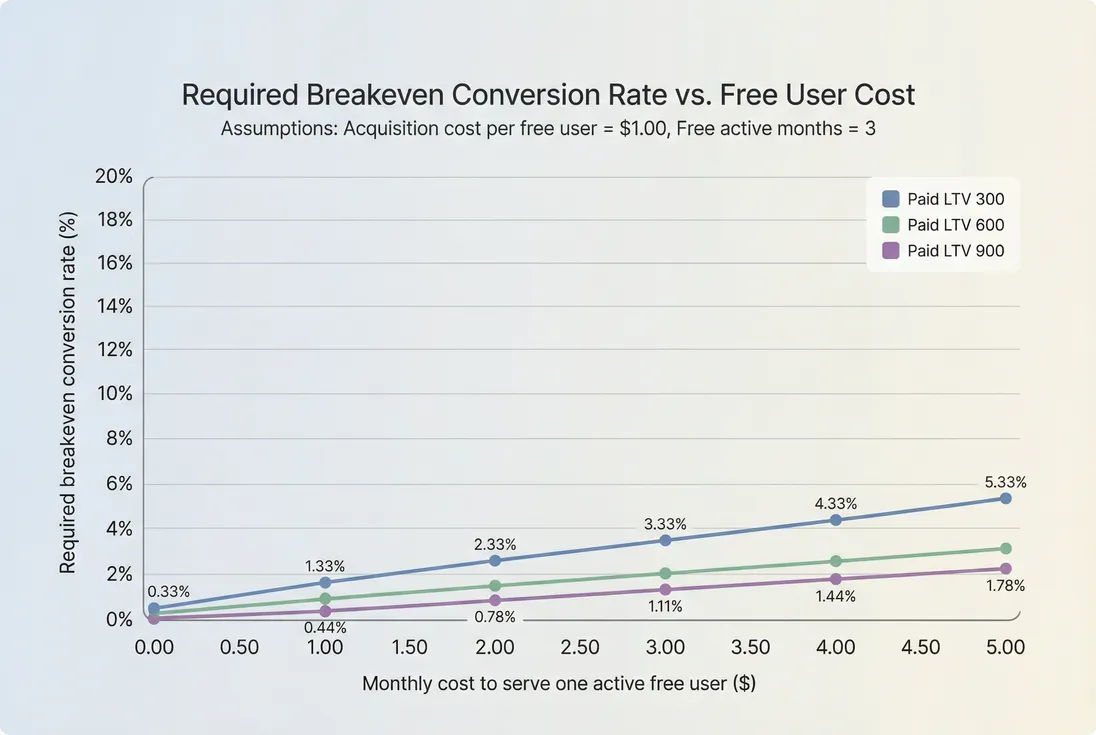

The Founder's perspective

If you're debating freemium limits, stop arguing abstractly. Put a dollar estimate on "monthly cost per active free user," then calculate how many paid conversions you need to cover it. When the team sees the breakeven math, packaging debates get much faster.

Benchmarks that are actually usable

Benchmarks vary wildly by category (developer tools vs. horizontal SaaS vs. consumer-ish prosumer). Still, these ranges help you sanity-check.

| Metric (monthly) | Typical range | Strong range | What it usually means |

|---|---|---|---|

| Free to paid conversion (from active free) | 1–3% | 3–7% | Packaging + upgrade triggers are working |

| Activated to paid conversion | 5–15% | 15–30% | Paywall matches value moment |

| Gross margin (paid) | 70–90% | 85–95% | Enough room to fund free users |

| Logo churn (self-serve SMB) | 3–7% | 1–3% | Retention is good enough to justify volume |

If you're below typical conversion, don't jump straight to "we need more top of funnel." First confirm activation and "aha" moments; then packaging.

How to design the free plan (so it converts)

Freemium succeeds when the free plan is valuable but incomplete in a way that becomes obvious through usage—not through marketing copy.

Good upgrade triggers

The best triggers are natural constraints users feel as they get value:

- Scale limits: projects, seats, automations, history, exports

- Collaboration: sharing, roles, permissions (ties to Per-Seat Pricing)

- Workflow maturity: integrations, API access, audit logs

- Reliability and governance: SLA, security controls (enterprise motion)

Triggers that backfire

- Hard blocks before value (forces users to churn before they believe)

- Limits that don't map to value (feels arbitrary)

- Free plan that's "too complete" for your target buyer (classic cannibalization)

If your free plan is converting poorly, don't default to cutting features. Often the fix is moving the paywall to the moment where value is already proven (post-activation), and clarifying the "why pay" with packaging that matches use cases.

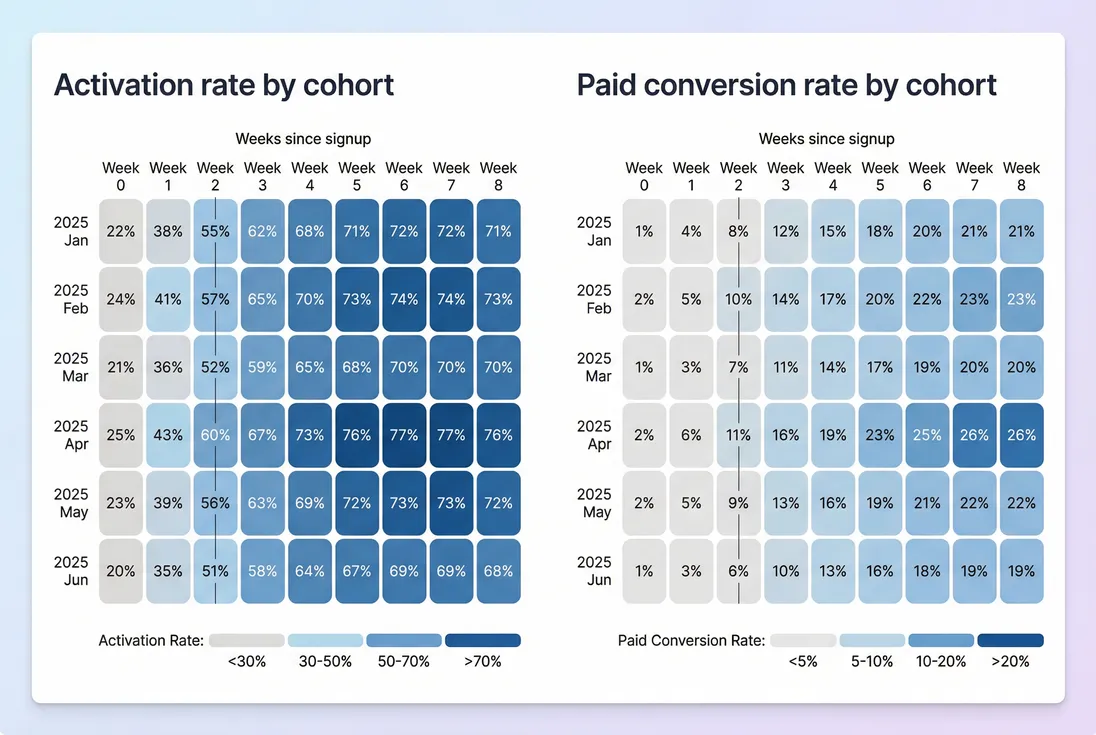

What freemium data should look like over time

Freemium is a lagging system: signups happen first, upgrades later. This is why cohorting matters.

Use Cohort Analysis to answer:

- Do newer cohorts activate faster (onboarding improvements)?

- Do they convert at higher rates (packaging improvements)?

- Do converted users retain better (product and customer quality)?

Interpreting changes correctly

Common scenarios:

- Signups up, activation flat: channel quality dropped or onboarding can't handle volume.

- Activation up, conversion flat: users get value but don't hit a strong reason to pay (limits too high, pricing unclear, or paid features not compelling).

- Conversion up, churn up: users are upgrading too early (misaligned paywall) or you're attracting low-intent buyers.

Tie conversion improvements to retention metrics like Retention and churn metrics like MRR Churn Rate to ensure you're not "pulling revenue forward" from customers who won't stick.

A breakeven framework founders can use

You don't need a perfect model; you need a decision model. Here's a clean way to think about "How much conversion do we need?"

Define:

- Paid LTV (gross margin adjusted)

- Monthly cost per active free user

- Average active months a free user stays "in funnel" before churning to inactive

- Acquisition cost per free signup (even if mostly content-driven, it's rarely zero)

A simplified breakeven conversion rate:

The Founder's perspective

This is the "permission slip" to say no. If your realistic conversion rate is 2% and your breakeven is 8%, you don't need more brainstorming—you need a different free plan, lower COGS, higher ARPA, or a different acquisition strategy.

Freemium vs. free trial: a decision table

Freemium and trials can both work, but they optimize different things.

| Dimension | Freemium | Free trial |

|---|---|---|

| Best for | Ongoing value, habit-forming workflows | Evaluation of full product |

| Primary risk | Cost-to-serve and cannibalization | Low activation within trial window |

| Main lever | Upgrade triggers and packaging | Onboarding speed and sales follow-up |

| Typical motion | Self-serve PLG | PLG + sales assist or sales-led |

| Metric focus | Activated-to-paid conversion + retention | Trial-to-paid conversion + TTV |

If you're unsure, start with a trial when you need clearer qualification or your costs are high. Move to freemium only when you can serve free users cheaply and reliably convert based on usage.

How founders optimize freemium without chaos

1) Segment your free users by intent

Not all free users are equal. Build at least three segments:

- High intent: ICP firmographics, repeated usage, team invites

- Learning: sporadic use, exploring

- Costly: heavy usage with low upgrade likelihood

Your upgrade experience and limits should treat these differently (even if the plan is "one free plan").

2) Use product signals to time the upgrade ask

Upgrade prompts work best when users:

- Hit a limit that matters

- Invite teammates (collaboration moment)

- Attempt an advanced feature (governance, automation, export)

- Reach a usage threshold that correlates with retention

This is where Feature Adoption Rate and DAU/MAU Ratio (Stickiness) become practical: they tell you which behaviors predict long-term value.

3) Protect ARPA and pricing power

Freemium can quietly degrade monetization by anchoring value too low. Watch:

- ARPA (Average Revenue Per Account) trend for self-serve cohorts

- Discounting behavior (see Discounts in SaaS)

- Mix shift toward tiny plans

If freemium drives a flood of low-ARPA customers, your Net Revenue Retention (NRR) ceiling may drop, even if top-line MRR grows.

4) Watch for churn you caused

If you tighten the free plan, you'll see "free churn" (inactive/free users leaving). That's fine. The real risk is:

- More paid churn from customers who feel tricked

- Lower activation because free is too constrained

- Lower conversion because users can't reach value

Use Churn Reason Analysis on the paid side to validate whether packaging changes are creating negative sentiment.

When freemium breaks (and what to do)

Freemium usually breaks in one of four ways:

- Support overwhelm: free users create tickets like paying customers.

- Infrastructure blow-up: usage costs scale faster than revenue.

- Cannibalization: "real buyers" stay free because it's enough.

- Bad conversion math: upgrades happen, but churn wipes it out.

Practical fixes (in order):

- Add clear limits tied to value, not arbitrary friction.

- Reduce cost-to-serve (optimize infra, throttle abusive usage).

- Improve activation so you can tighten free while keeping value.

- Reposition freemium as a lead-in to a guided conversion (sales assist).

- If none of that works, replace it with a trial or "free with qualification."

The Founder's perspective

Killing freemium is not a failure if it restores pricing power and reduces burn. The failure is keeping freemium out of fear while it quietly lowers margins and distracts your team. Make the decision with conversion, gross margin, and retention data—not vibes.

A practical 30-day freemium audit

If you want an actionable plan, run this audit:

- Define activation (one event or small set of events).

- Measure activation rate by channel and segment.

- Compute conversion from activated to paid.

- Compare churn and retention for freemium-origin paid customers vs. other sources using Cohort Analysis.

- Estimate monthly cost per active free user and calculate breakeven conversion.

- Identify your top two upgrade triggers (limits or features) and A/B test packaging copy and placement.

The output should be a simple decision: double down, tighten, or switch models.

If you want to connect freemium outcomes to revenue reporting, pair this with MRR (Monthly Recurring Revenue) and retention metrics like NRR (Net Revenue Retention) so you're optimizing for durable growth—not just a bigger free user database.

Frequently asked questions

Many healthy freemium products land around 1 to 5 percent monthly conversion from active free users to paid, with top-performing, high-intent products reaching higher. The key is segmenting by activation and intent: conversion from activated free users is the real benchmark, not conversion from all signups.

Freemium hurts when free users consume meaningful support or infrastructure, but don't create enough paid expansion to cover that load. Watch paid pipeline cannibalization, sales cycle lengthening, and a drop in ARPA. If higher-intent buyers downgrade to free, packaging is too generous or pricing is unclear.

Choose freemium when the product has ongoing standalone value at low marginal cost, and you can drive self-serve upgrades through usage triggers. Choose a free trial when value is only clear with full access, when you need strong qualification, or when infrastructure and support costs make indefinite free users uneconomic.

Track activated free users and the conversion rate from activated to paid. Total signups are usually vanity. Activation proves the product is delivering value; activated-to-paid conversion proves the paywall and packaging work. Pair it with gross margin and churn metrics to confirm upgrades become durable revenue.

Restrict or kill freemium when you can't find a path to positive unit economics within a reasonable horizon, or when your best customers refuse to pay because free is sufficient. Before shutting it down, test tighter limits, stronger upgrade prompts, and better qualification so you preserve top-of-funnel learning.