Table of contents

Go to market strategy

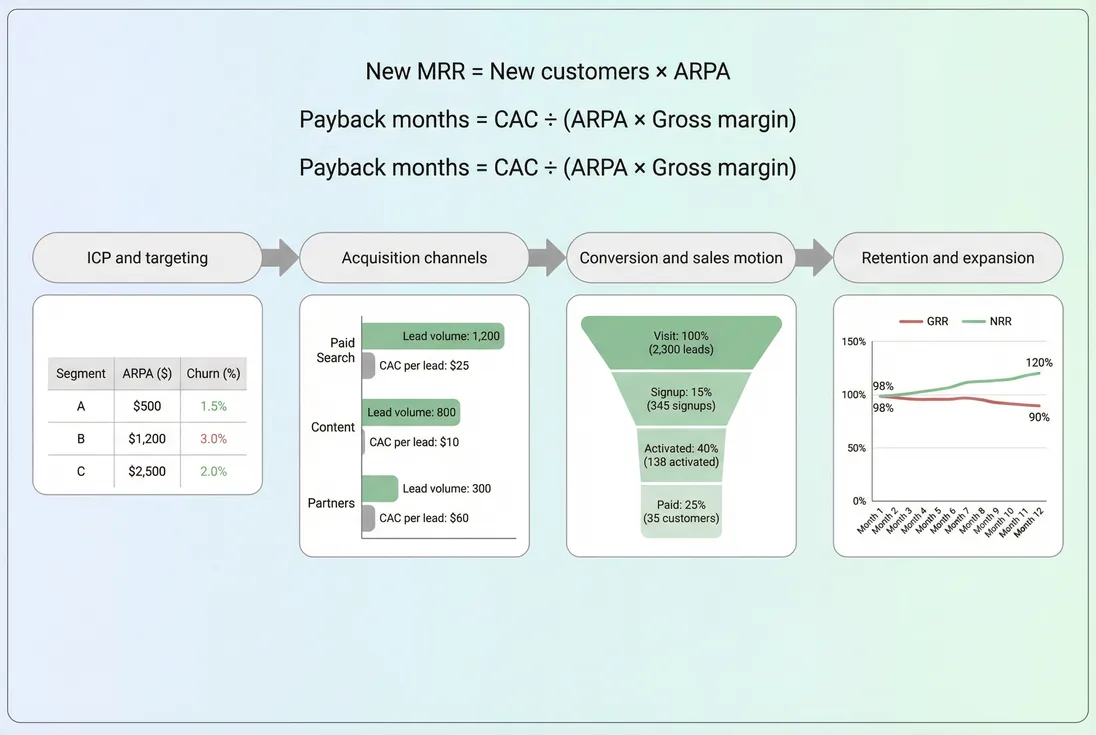

Most SaaS "growth problems" are actually go-to-market problems: you're acquiring the wrong customer, with the wrong promise, through the wrong channel, at a cost your retention can't support. Fixing GTM isn't about adding more tactics—it's about making your acquisition motion, pricing, and customer outcomes mathematically compatible.

A go-to-market (GTM) strategy is your company's operating plan for turning a defined customer profile into predictable recurring revenue—by choosing who you sell to, how they buy, how you reach them, how you price, and how you retain and expand them.

What GTM actually controls

Founders often treat GTM like "marketing + sales." In practice, GTM is the system that controls four levers:

- Demand creation: how prospects discover you (channels, positioning, category)

- Demand capture: how prospects become pipeline or sign up (funnel, sales process)

- Monetization: what a customer pays and how that grows (pricing, packaging, expansion)

- Durability: whether revenue sticks (activation, retention, churn, renewal)

The reason GTM is so consequential is simple: these levers multiply.

And:

If any part of that chain is weak (low lead quality, weak conversion, low ARPA, poor retention), scaling spend usually makes the problem louder, not better.

The Founder's perspective: If you can't point to the one constraint limiting growth this quarter (lead volume, conversion, ARPA, or churn), you don't have a GTM strategy—you have a list of activities.

Which GTM motion fits best

Your "motion" is how a customer experiences buying: self-serve, assisted, or enterprise sales. You can mix motions, but you can't avoid choosing a default.

Use this table as a practical starting point:

| Motion | Best when | Typical ACV / ARPA shape | Common failure mode | What to measure first |

|---|---|---|---|---|

| Product-led | Fast time-to-value, low friction, clear single-user benefit | Lower ARPA, higher volume | Low activation, high churn, weak expansion | Conversion Rate, Onboarding Completion Rate, DAU/MAU Ratio (Stickiness) |

| Sales-led | Multi-stakeholder buy, compliance, high switching costs | Higher ARPA, lower volume | Long cycle, poor win rate, CAC spikes | Sales Cycle Length, Win Rate, CAC (Customer Acquisition Cost) |

| Hybrid | Product qualifies and expands, sales closes larger deals | Wide ARPA distribution | Confusing handoffs, misaligned incentives | Lead-to-Customer Rate, ARPA (Average Revenue Per Account), NRR (Net Revenue Retention) |

A fast diagnostic: if customers can reach meaningful value in minutes or hours, Product-Led Growth is viable. If value requires data migration, workflow change, or stakeholder alignment, expect Sales-Led Growth or at least an assisted layer.

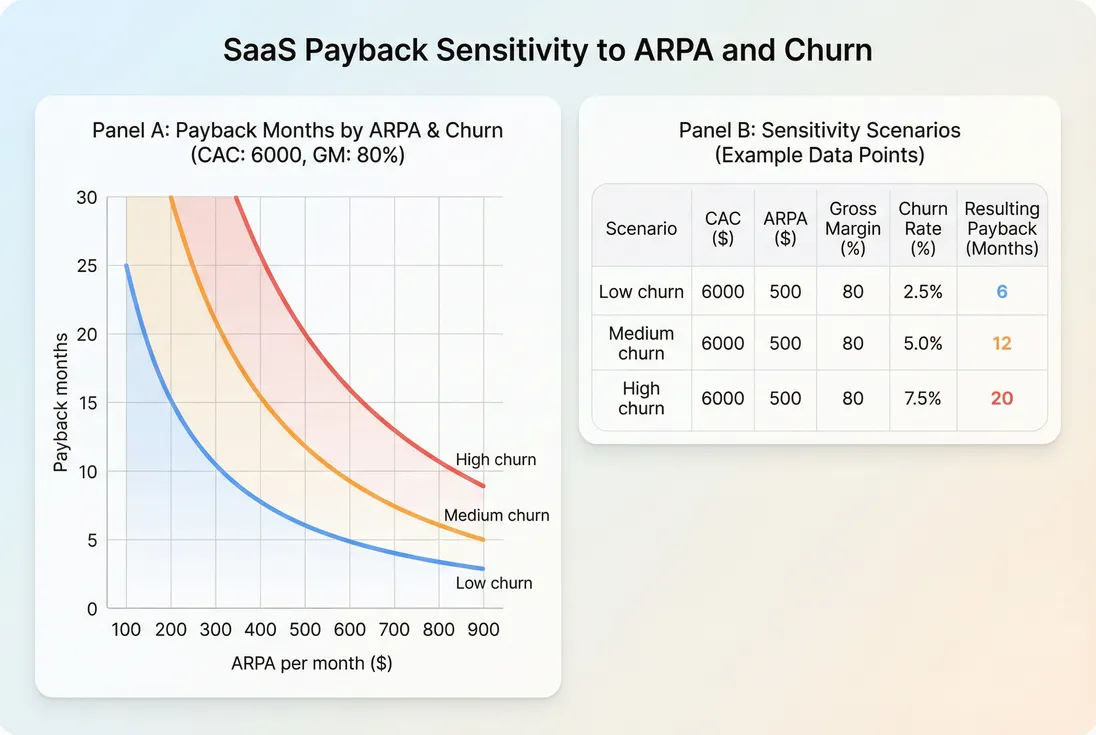

The motion must match your price

Your ASP and packaging are not just monetization—they are GTM control knobs. A $49 plan can't carry a human-heavy sales process. A $25k ACV product usually can't rely on "try it and swipe a card" unless the product is already a category standard.

If you are unsure, sanity-check with payback math.

The unit economics math behind GTM

You don't "calculate" a GTM strategy like a single metric, but you can calculate whether it's economically coherent.

Payback is the fastest GTM truth test

A practical payback approximation:

- CAC comes from your channel mix + conversion + sales effort.

- ARPA comes from pricing + packaging + segment.

- Gross margin comes from hosting, support load, third-party costs (see COGS (Cost of Goods Sold)).

If payback is getting worse as you "scale," your GTM is probably pushing into lower-quality demand or forcing discounts.

Related metrics that sharpen the picture:

LTV is not a wish—churn sets the ceiling

A common simplified LTV model:

If churn rises (logo churn or revenue churn), LTV collapses even if top-line growth looks good. That's why GTM strategy must include onboarding, success, and product outcomes—not as "CS work," but as the mechanism that protects LTV.

Use these for consistent retention definitions:

The Founder's perspective: Don't ask "Can we grow faster?" Ask "Can we grow faster without payback extending and churn rising?" If the answer is no, you're not ready to scale spend—you're ready to narrow ICP, improve activation, or change packaging.

Where founders use GTM to make decisions

A usable GTM strategy should help you answer a few high-stakes questions quickly.

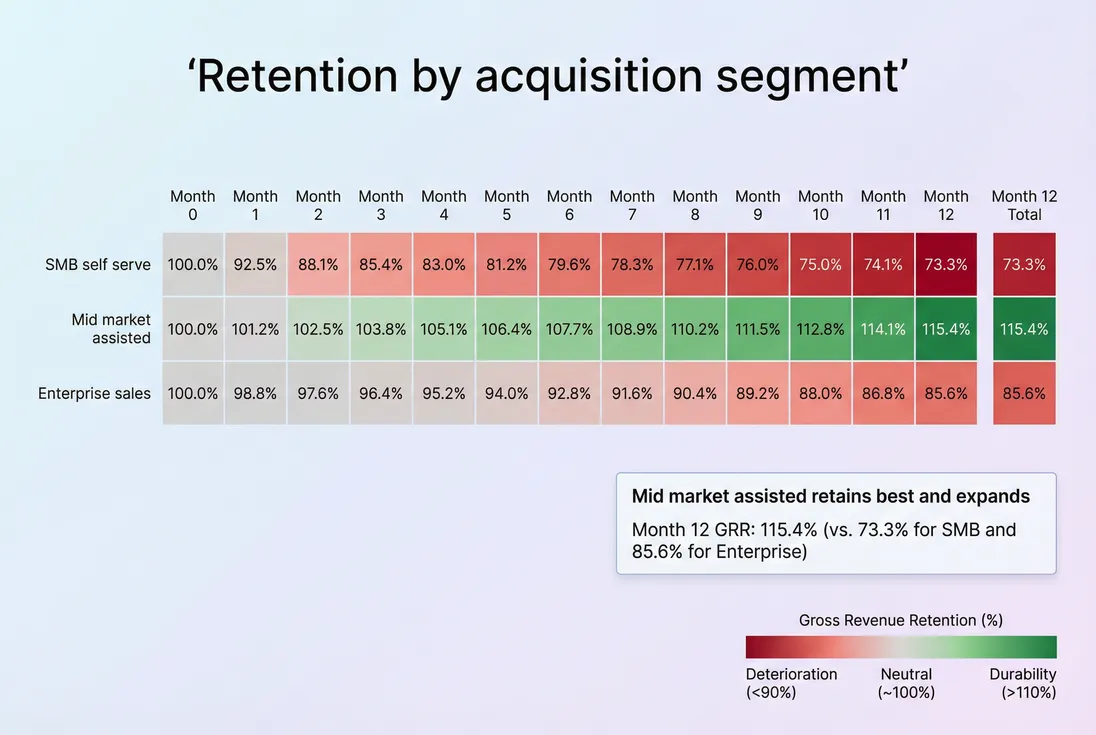

1) Who is the ICP that pays and stays

An ICP definition that doesn't include retention is incomplete. The best ICP is usually the segment with the best combination of:

- High ARPA (Average Revenue Per Account)

- Low Logo Churn (they stick)

- Strong expansion (drives NRR (Net Revenue Retention))

- Short sales cycle and high win rate (if sales-led)

A practical workflow:

- Segment customers by firmographics (size, industry) and use case.

- Compare retention and expansion by segment (cohorts).

- Look for "quiet winners": segments that grow steadily with low support burden.

If your biggest customers dominate results, watch Customer Concentration Risk and Cohort Whale Risk. One whale can trick you into thinking your GTM is working.

2) Which channels create profitable demand

Channel selection is not about volume. It's about efficient customers.

Two founders can spend the same amount and get the same number of customers, but one ends up with:

- higher discounts,

- higher churn,

- longer time-to-value,

- and worse payback.

That is a GTM mismatch: the channel is pulling in buyers who were never a fit or were sold the wrong expectation.

Practical channel scorecard (per channel, per ICP):

- CAC and CAC Payback Period

- Lead-to-customer rate and cycle time

- ARPA and discounting (see Discounts in SaaS)

- 90-day retention and expansion trend

If you want a single "tell," it's this: channels that work keep working in cohorts. If early cohorts are okay but later ones churn, you're saturating the channel or widening targeting too far.

3) What pricing and packaging should do

Pricing is a GTM lever because it changes who converts, how fast you pay back CAC, and whether expansion is available.

A few concrete patterns founders use:

- If conversion is strong but payback is long, improve entry pricing and onboarding to lift ARPA without introducing sales friction.

- If churn is high at low tiers, consider raising the floor and narrowing the ICP (fewer "tourists").

- If expansion is the strategy, packaging must align with a value metric (seats, usage, modules). See Per-Seat Pricing and Usage-Based Pricing.

Connect the decisions to measurable outcomes:

- ARPA lift improves payback directly.

- Expansion improves NRR (Net Revenue Retention).

- Discounting can mask weak differentiation while hurting future renewals.

Related reading: ASP (Average Selling Price), Price Elasticity.

4) What to fix first when growth stalls

When growth slows, many teams default to "more leads." Often the issue is lower in the chain.

Use a constraint-first checklist:

Lead quality problem: volume is fine, conversion and retention drop

Fix: tighten ICP, adjust messaging, cut broad channels, improve qualification.Activation problem: signups rise, paid conversion and early retention lag

Fix: onboarding, time-to-value, remove setup steps, improve in-product guidance.Monetization problem: customers succeed but ARPA is too low

Fix: packaging, upsell path, annual plans, clearer value metric.Retention problem: acquisition works but churn or contraction kills net growth

Fix: customer success focus, product gaps, align promises with reality, address top churn reasons (see Churn Reason Analysis).

If you need a financial lens to force prioritization, combine:

The Founder's perspective: The "right" GTM initiative is the one that improves the bottleneck metric and reduces risk. Example: fixing activation improves conversion, retention, and reduces support load—often a better bet than adding a new paid channel.

When GTM breaks (and what it looks like)

GTM breakage has recognizable patterns. Here are the common ones and the decision they imply.

You scale spend, but efficiency collapses

Symptoms:

- CAC up, payback up

- Win rate down

- Discounts increasing

- Sales cycle lengthening

Interpretation: you've moved outside your ICP or saturated a channel. Tighten targeting and refresh positioning before spending more.

You have growth, but net revenue does not compound

Symptoms:

- New MRR is decent, but NRR (Net Revenue Retention) is weak

- Expansion is rare, contraction is common (see Contraction MRR)

- Support load increases as you add customers

Interpretation: you're acquiring "buyers," not "successful users." Either your onboarding is failing or you're selling to the wrong use case.

Enterprise deals close, but cash and ops get strained

Symptoms:

- Big ARR jumps, but implementation drags

- Deferred go-lives and delayed value

- Collections and invoicing complexity increases (see Accounts Receivable (AR) Aging)

Interpretation: moving upmarket changes the company. You likely need better qualification, implementation capacity, and a tighter definition of what you will and won't support.

How to evolve GTM as you grow

A GTM strategy is not a one-time plan. It evolves with product maturity, brand, and customer size.

Early stage: prove a repeatable path

Focus:

- One ICP

- One primary channel

- One motion (mostly)

Primary goal: prove you can acquire customers with acceptable payback and early retention.

Metrics to watch:

- CAC (Customer Acquisition Cost) trend by channel

- Activation and 30 to 90 day retention

- ARPA (Average Revenue Per Account)

Growth stage: add channels and tighten the machine

Focus:

- Channel diversification

- Conversion optimization

- Packaging and expansion paths

Primary goal: increase throughput without sacrificing payback and churn.

Metrics to watch:

- CAC Payback Period by cohort

- NRR (Net Revenue Retention) and GRR (Gross Revenue Retention)

- Revenue Growth Rate versus Burn Multiple

Expansion stage: move upmarket deliberately

Focus:

- New segments with different buying constraints

- Sales enablement, implementation, security posture

- Stronger renewal and success motion

Primary goal: increase ARPA while protecting retention and operational efficiency.

Metrics to watch:

- Sales cycle length, win rate

- Customer Concentration Risk

- Renewal performance (see Renewal Rate)

A simple GTM review cadence for founders

If you want GTM to stay grounded, run a monthly review that answers four questions:

- What changed in acquisition? (channel mix, CAC, lead quality)

- What changed in conversion? (activation, sales cycle, win rate)

- What changed in monetization? (ARPA, discounting, expansion)

- What changed in durability? (churn, retention cohorts, NRR)

If you use GrowPanel, the most direct way to keep this honest is to review:

- MRR (Monthly Recurring Revenue) and movements in MRR movements

- retention trends in Cohort Analysis and the cohorts report

- segmentation using filters to compare channels, plans, and acquisition periods

The goal is not more reporting. It's faster correction when the system drifts.

Practical takeaway

A good go-to-market strategy is a set of choices that make your growth math work: the right ICP, the right motion, the right channels, and pricing that produces payback and retention you can scale. If you can't explain why your CAC, ARPA, and churn are moving—and what you'll change next—you're not managing GTM yet.

Frequently asked questions

Your GTM is working when acquisition volume, conversion, payback, and retention improve together, not just one metric. Track CAC, CAC Payback Period, ARPA, and churn side by side. If growth rises but payback worsens or churn spikes, you are likely buying unprofitable customers.

As a starting point, many SMB SaaS teams aim for CAC payback under 12 months, mid market under 18 months, and enterprise under 24 months. For LTV to CAC, 3 to 1 is a common target. Use these as guardrails, then adjust for margin and cash constraints.

Move up the funnel when self serve conversion stalls due to security, compliance, procurement, or multi stakeholder buying. Another signal is expansion potential that requires human guidance. If ARPA and retention rise materially with assisted onboarding, you can justify sales costs, as long as payback stays healthy.

Treat channels like experiments with explicit success criteria: target CAC, conversion rate, and cycle time. Run small tests, then scale only the channels that beat your payback threshold and produce customers with strong retention. If a channel converts but churns, your targeting or expectations are off.

Pause scaling when CAC rises faster than ARPA, payback lengthens for several cohorts, or churn increases among customers acquired from new campaigns. Also watch sales cycle length and win rate. If pipeline quality drops, you are likely pushing beyond your current ICP and messaging.