Table of contents

T3MA (trailing 3-month average)

A single "bad month" can cause founders to freeze hiring, cut acquisition spend, or abandon a pricing test—when the business was actually fine. T3MA is a simple way to stop overreacting to noise and start managing the trend.

T3MA (Trailing 3-Month Average) is the average value of a metric across the most recent three completed months. You can apply it to almost any monthly SaaS KPI—MRR growth, churn, NRR, signups, pipeline—to smooth short-term volatility and reveal the underlying direction.

What T3MA reveals

T3MA answers a practical founder question: are we actually improving, or are we just getting lucky (or unlucky) with timing?

Founders usually adopt T3MA when they run into one (or more) of these realities:

- Deal timing volatility: especially with enterprise, one contract can swing the month.

- Seasonality: budget cycles, holidays, summer slowdowns, end-of-quarter pushes.

- Billing artifacts: annual prepay months, prorations, plan migrations, refunds.

- Small numbers: early-stage churn and upgrades are "lumpy" because you have fewer customers.

T3MA is most useful when you're trying to make decisions with longer consequences than a single month:

- hiring pace and runway planning (pair with Burn Rate and Runway)

- scaling paid acquisition (pair with CAC (Customer Acquisition Cost) and CAC Payback Period)

- board updates and investor narrative (pair with ARR (Annual Recurring Revenue) or MRR (Monthly Recurring Revenue))

- understanding retention direction (pair with Net MRR Churn Rate or NRR (Net Revenue Retention))

The Founder's perspective

I don't use T3MA to make the week-to-week calls. I use it to set the company's pace. If T3MA is rising, I can keep investing even if this month looks messy. If T3MA turns down, I slow down—even if the latest month happens to look okay.

How to calculate it

At its core, T3MA is a rolling average over three months.

If M(t) is your monthly metric value in month t, then:

A few practical notes:

- Use completed months. Partial months distort results, especially for sales-led businesses.

- Be consistent about what month means. Calendar month is typical; 4-4-5 fiscal calendars can work too.

- Rates vs dollars: you can average both, but interpret them differently.

- Averaging dollars (like net new MRR) smooths timing.

- Averaging rates (like churn %) can hide step-changes; still useful, but watch lag.

A concrete example

Say your raw monthly MRR churn rate is:

| Month | MRR churn rate |

|---|---|

| April | 2.0% |

| May | 3.5% |

| June | 2.5% |

Then June's T3MA churn is (2.0% + 3.5% + 2.5%) / 3 = 2.7%.

That 2.7% is the "steady-state" view: it's less reactive than May's spike, but it still incorporates it.

T3MA vs other smoothing choices

T3MA is a compromise between noise reduction and responsiveness:

| Method | Pros | Cons | When to use |

|---|---|---|---|

| Raw month | Fast, honest, great for ops | Extremely noisy | Weekly exec reviews, incident response |

| T3MA | Smooth but still responsive | Lags by ~1 month | Planning, targets, trend calls |

| Trailing 6-month average | Very stable | Can hide turns for too long | Highly seasonal businesses |

| Median of last 3 months | Resistant to outliers | Less intuitive for boards | When one-off spikes are common |

What drives T3MA up or down

T3MA doesn't have drivers of its own. It's a lens over a base metric. So the right way to "debug" a T3MA move is:

- Identify which month entering/leaving the 3-month window caused the change.

- Decompose the underlying metric in that month.

For revenue metrics, decomposition is usually where clarity comes from. If you're averaging net new MRR, the biggest contributors typically map to:

- Expansion MRR

- Contraction MRR

- MRR Churn Rate (or churn dollars)

- Reactivation MRR

- pricing and packaging changes (often expressed via ARPA (Average Revenue Per Account) or ASP (Average Selling Price))

- discounting and credits (see Discounts in SaaS and Refunds in SaaS)

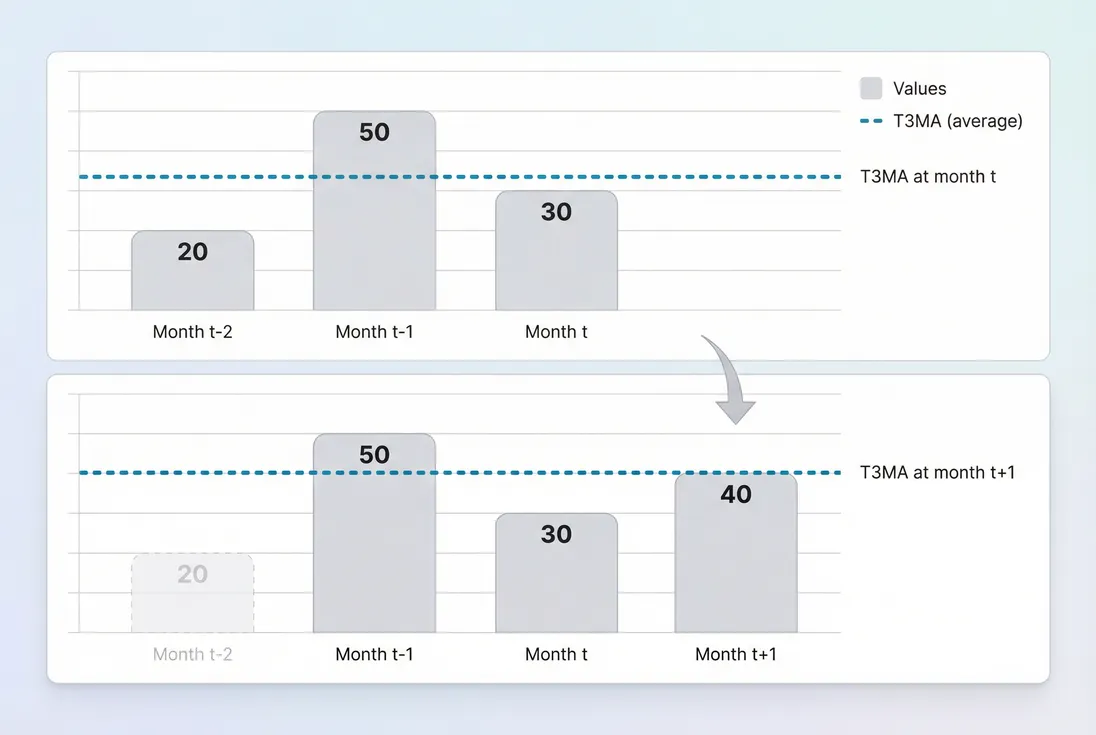

The key interpretation rule

When T3MA moves, it means the newest month is better or worse than the month that just dropped out.

- If T3MA rises: the latest month outperformed the month from three months ago.

- If T3MA falls: the latest month underperformed the month from three months ago.

This is why T3MA is so effective for trend calls: it forces you to compare "now" to a recent baseline, not to the most recent (possibly weird) month.

How founders use it in decisions

T3MA is not just a reporting trick. It changes behavior—especially around spend, hiring, and "is the GTM working?"

1) Setting growth expectations without self-sabotage

If you set targets off raw month-to-month performance, you'll whipsaw the team:

- one strong month sets unrealistic expectations

- the next normal month looks like failure

- leaders change strategy too often

Instead, use T3MA for:

- quarterly goal setting

- "are we on track?" checks mid-quarter

- capacity planning (sales headcount, CS coverage)

Pair it with a clear primary revenue metric like MRR (Monthly Recurring Revenue) or ARR (Annual Recurring Revenue).

The Founder's perspective

We don't change the plan because one month was great or terrible. We change the plan when T3MA changes direction. That's the difference between managing a business and managing emotions.

2) Knowing if retention is getting better

Retention improvements usually show up as gradual change, but churn is often "spiky" (a few cancellations, one failed renewal, a billing incident).

Using T3MA on retention metrics helps you call improvements earlier with more confidence:

- Logo Churn T3MA: are we keeping more customers overall?

- Net MRR Churn Rate T3MA: are expansions offsetting churn more consistently?

- GRR (Gross Revenue Retention) T3MA: are we reducing downgrades and cancellations?

What you do with the insight:

- If T3MA churn is rising: prioritize churn drivers (onboarding gaps, support backlog, failed payments, product reliability). Use Churn Reason Analysis to avoid guessing.

- If T3MA churn is falling: you can safely scale acquisition harder because LTV is likely improving (see LTV (Customer Lifetime Value)).

3) Making spend decisions with fewer regrets

If your net new MRR is volatile, CAC efficiency metrics will also be volatile. T3MA helps you avoid scaling spend on a spike.

A practical decision workflow:

- Track T3MA of net new MRR (or bookings).

- Track T3MA of CAC Payback Period (or CAC if you have clean attribution).

- If growth T3MA is rising and payback T3MA is stable/improving, increase spend gradually.

- If growth T3MA is flat/falling, don't "buy your way out" until you understand whether it's pipeline, conversion, pricing, or churn.

If you're managing burn, pair with Burn Multiple so you're not just growing—you're growing efficiently.

4) Preventing pricing tests from being misread

Pricing and packaging changes often cause short-term distortion:

- annual upgrades land in a single month

- discounts get applied unevenly

- downgrades lag as customers renew

T3MA won't tell you whether pricing is good, but it will keep you from declaring victory or failure too quickly. Combine it with:

- ARPA (Average Revenue Per Account) trend

- ASP (Average Selling Price) trend

- cohort-based retention views (see Cohort Analysis)

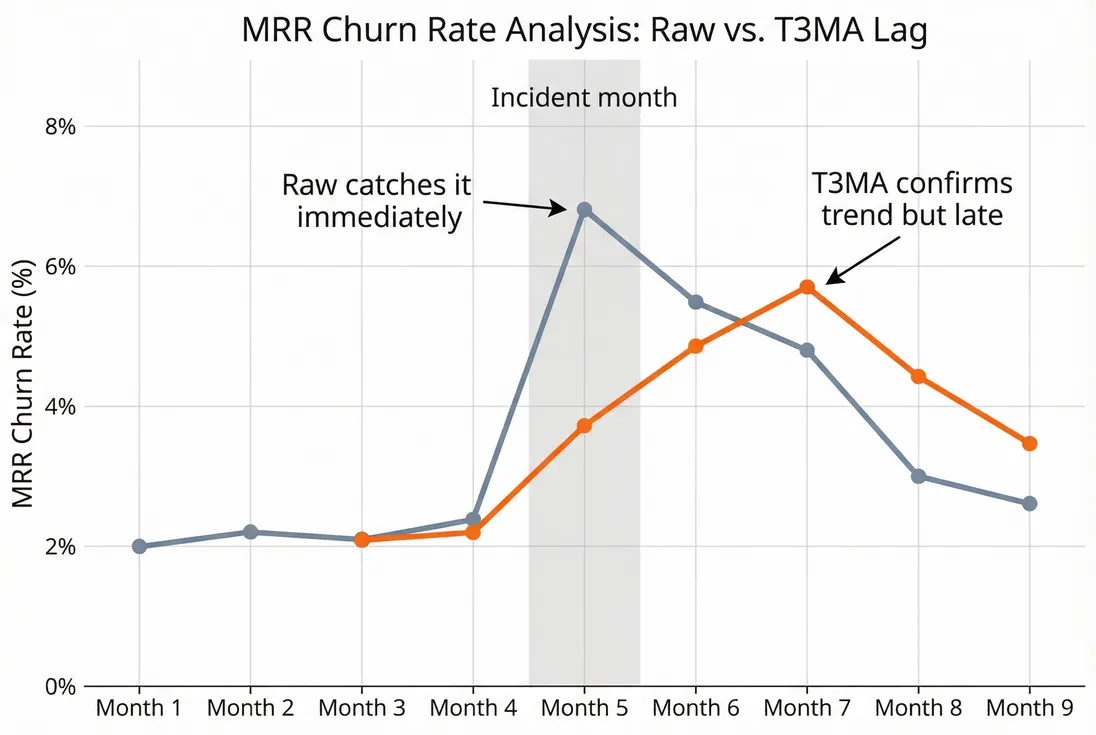

Where T3MA misleads

T3MA is intentionally "slow." That's both its strength and its failure mode.

1) It lags during real regime changes

If something truly breaks—an outage causes churn, a competitor undercuts you, a channel dies—T3MA can look "fine" for a month or two because older good months are still in the average.

Mitigation:

- Always show raw monthly and T3MA together.

- Set alert thresholds on the raw metric (for example, raw churn rate above X%).

- Use a leading indicator alongside (pipeline, activation, product usage).

2) It can understate your current run-rate

If you're growing quickly, T3MA will be lower than your latest month by definition. That can cause conservative planning (sometimes good) but also missed opportunities (hiring too slowly, underinvesting in a working channel).

Mitigation:

- Use T3MA for "trend," and use current month (or a forward-looking model) for "capacity."

- If you have strong seasonality, consider a longer lens like trailing 6-month average or year-over-year comparisons (see LTM (Last Twelve Months) Revenue).

3) It breaks down with very low volume

If you have only a handful of customers, one cancellation can dominate three months. T3MA is still mathematically correct, but it may not be decision-useful.

Mitigation:

- Segment T3MA by customer type (SMB vs enterprise).

- Use counts and dollars: pair churn rate with absolute churned MRR and customer count.

- Look at concentration risk (see Customer Concentration Risk) so you understand how much "one customer" matters.

Practical setup and reporting cadence

A clean way to operationalize T3MA without overcomplicating your dashboard:

- Pick 1–2 "north star" time series where volatility hurts decision-making:

- net new MRR

- churn (logo or MRR)

- NRR / GRR

- Show two lines for each:

- raw monthly

- T3MA

- Add a lightweight monthly review:

- If raw moved but T3MA did not: likely noise or timing; investigate briefly, don't pivot.

- If T3MA moved for 2 consecutive months: treat as a real trend; open a structured investigation.

Where founders get the most leverage is combining T3MA with diagnostic views:

- Use retention breakdowns and cohorts (see Cohort Analysis) to understand whether the trend is coming from newer or older customers.

- Use revenue movement breakdowns to identify whether the trend is new sales vs expansion vs churn (see MRR (Monthly Recurring Revenue) and related MRR components).

The Founder's perspective

My rule: raw numbers tell me what happened; T3MA tells me what's changing. I react fast to raw only when it's an operational emergency. I change strategy when the T3MA trend says the business has actually shifted.

The simplest way to use T3MA well

If you do nothing else:

- Put raw monthly and T3MA on the same chart for your key metric.

- When T3MA moves, ask: which month dropped off, and what replaced it?

- Then diagnose the underlying driver (new revenue, expansion, churn, pricing) before you change the plan.

That's what T3MA is really for: fewer knee-jerk decisions, faster recognition of real trend changes, and a steadier operating cadence.

Frequently asked questions

Use T3MA when your month-to-month metric is noisy enough to trigger bad decisions: small customer counts, seasonal buying, annual prepay spikes, enterprise deal timing, or heavy expansion and churn variability. Keep MoM for operational triage, but use T3MA for planning, targets, and board-level trend tracking.

Only if the underlying metric is one where higher is good. A higher T3MA of net new MRR is good; a higher T3MA of churn is bad. The value of T3MA is stability, not direction. Always label the underlying metric clearly and pair it with the raw monthly number to catch turning points.

T3MA itself is not benchmarked; it inherits benchmarks from the metric you average. Benchmark your T3MA churn against churn norms, or your T3MA net MRR churn against retention standards. The practical benchmark is volatility: if T3MA changes direction, assume the business trend changed, not just noise.

A T3MA drop means at least one of the last three months was materially weaker than the months it replaced. First, compare the current month to the prior two months to identify the culprit. Then decompose the underlying driver: new sales slowed, expansion weakened, contraction increased, or churn spiked.

Yes. T3MA lags by design. If churn spikes this month, the 3-month average may still look acceptable for a few weeks, especially after strong prior months. Mitigate this by always showing the raw monthly metric alongside T3MA, and set alert thresholds on the raw value for fast response.