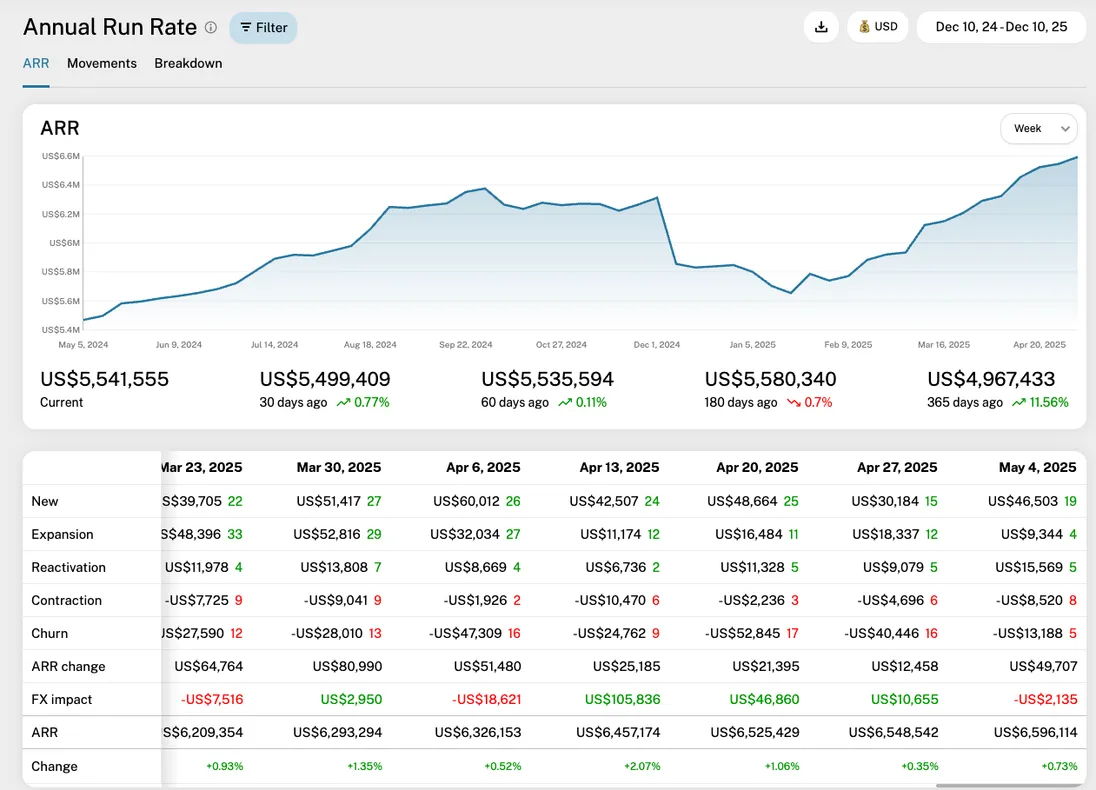

ARR

The ARR (Annual Run Rate or Annual Recurring Revenue) report provides a detailed view of your annualized subscription revenue over time. It is a central tool in GrowPanel for tracking long-term growth, understanding revenue trends, and identifying customer behavior patterns on an annual scale.

ARR is calculated as Monthly Recurring Revenue (MRR) multiplied by 12.

For an in-depth explanation of ARR as a metric, see the ARR guide in the SaaS Metrics Academy.

Overview

The ARR report includes a chart, a breakdown table, and optionally a detail table. Each is described here:

Timeline chart

The timeline chart shows your ARR over the selected period. If you hover the chart, you'll see a tooltip with the ARR movements broken down in types (explained under the Breakdown table), and you'll see the corresponding period marked in the table underneath. The currenly ongoing period is marked as a dashed line. You can adjust the chart data using the date picker, currency picker, interval selector and a wealth of filters, explained in the Filters section underneath.

Note that the numbers for a given period shows how those numbers looked at the end of the period.

Breakdown table

The table underneath the chart shows the ARR, broken down into ARR movement types: New, expansion, reactivation, contraction, churn. It also shows Net ARR movements and currency fluctuations (FX impact). The table scrolls horizontally and if you hover the columns, you'll see a line in the chart showing the corresponding period. Each type is explained here:

New

Annual recurring revenue from newly acquired customers (calculated as New MRR x 12).

Expansion

Annual recurring revenue growth from existing customers due to upgrades, discount changes or billing frequency updates. A change from yearly to monthly payment can also contribute to expansion if the monthly plan results in a higher annual revenue.

Reactivation

Annual recurring revenue recovered from returning customers that previously churned (calculated as Reactivation MRR x 12).

Contractions

Reductions in annual recurring revenue from downgrades, discount changes, prices changes or billing frequency changes. A change from monthly to yearly payment can also contribute to contraction if the annual plan is cheaper on an annual basis.

Churn

Annual recurring revenue lost from cancellations. A cancellation is classified as a churn when the customer does not have any other active subscriptions, and the ARR is zero.

ARR change

Net ARR change from real ARR movements (doesn't include currency fluctuations).

FX impact

Changes due to currency exchange rate fluctuations. This line is only shown if customers pay in a currency that's different that the reporting currency.

ARR

The ARR at the end of the period, including both ARR movements and FX impact.

Each cell of the table shows two numbers - an amount and a number. The amount shows the sum of the ARR movement type in the given period. Negative amounts are typically marked with a minus in front, depending on your locale. The number next to the amount shows the number of unique customers that contributed to this number. If a customer has multiple movements during the period, it's still only counted as one unique customer. Red numbers mean that the customers contributed with negative ARR, and green numbers mean positive ARR movements.

If you click a cell, a detail table under the breakdown table is revealed, showing all ARR movements in the selected period and type.

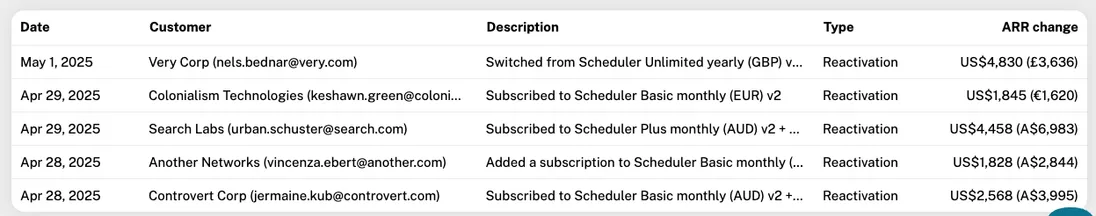

Detail table

This table is shown when you click a cell in the breakdown table. The table shows each ARR movement in the selected period and type. You see the date, customer name/email, the description of the ARR movement, the type (New/Expansion/Reactivation/Contraction/Churn) and the ARR change. If the ARR change is in a different currency than the reporting currency, you see the converted amount as well as the original amount in parantheses.

Clicking the customer sends you to that customer's detail page.

Filters

The report supports a wide range of filters to help you focus on specific segments of your business. These include:

Date range

Select a custom range or preset periods (last 30 days, last quarter, etc.)

Interval

Choose how ARR is aggregated: daily, weekly, monthly, quarterly, or yearly

Currency

Select your reporting currency. When switching reporting currency, the reports are calculated on the fly using daily historical exchange rates. If you want to fix/freeze FX rates in your reports, you can tick a checkbox, and all FX rates are fixed at the start date of the report. Example: if you see "Year to date", all FX rates will be fixed at the 1st of january.

Additional filters – plan, region/country, billing frequency, payment method, customer age, etc. (see all filters)

Filters are applied to both the chart and the table simultaneously.

Exporting the data

You can export the table as a CSV file for offline analysis or reporting by clicking the "Export" icon next to the date picker.

Practical tips

- Use the interval selector to understand trends at different granularities. Monthly intervals are useful for spotting short-term fluctuations in the annual run-rate, while quarterly or yearly intervals give a longer-term view.

- Use "All time" in the date picker to show you the numbers from when your first customer signed up.

- Fixing the currency is recommended when analyzing historical performance across multiple currencies, as it removes FX volatility from the analysis.

- Combine multiple filters to isolate specific customer segments or product lines, enabling precise revenue insights.