Customer Concentration

The Customer Concentration report measures how much of your recurring revenue depends on your largest customers. High concentration means a few customers account for a significant portion of your MRR, which creates dependency risk. Low concentration indicates a more diversified and resilient customer base.

This report helps you identify revenue risk, understand your customer distribution, and plan for healthier business diversification.

For an in-depth explanation of Customer Concentration Risk, see the Customer Concentration Risk article.

Overview

The Customer Concentration report includes three main sections:

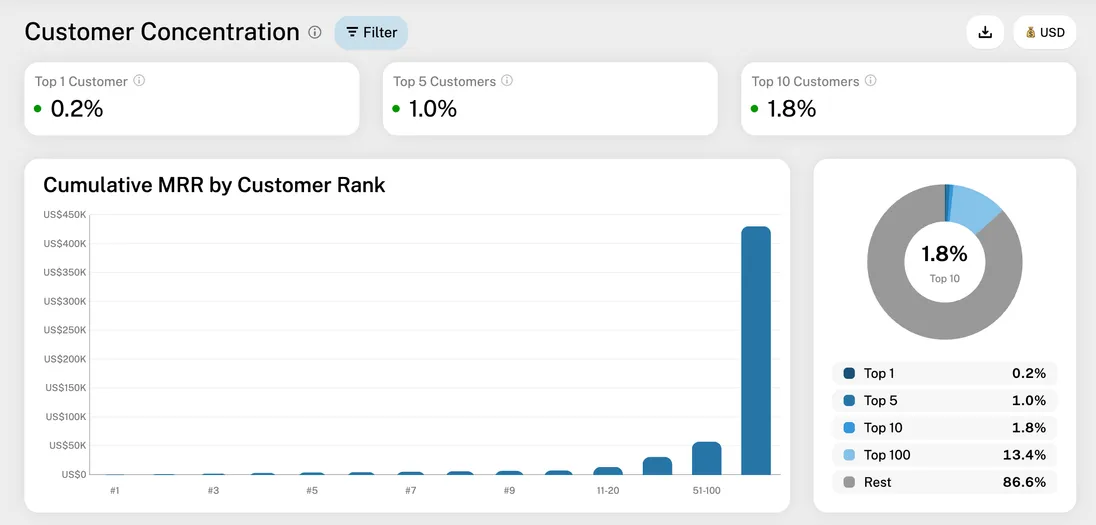

- Concentration metrics – Three summary widgets showing your Top 1, Top 5, and Top 10 customer concentration

- Pareto chart and pie chart – Visual representations of cumulative MRR distribution

- Top 50 customers table – A detailed list of your highest-revenue customers

Concentration metrics

At the top of the report, three metric widgets display the percentage of total MRR that comes from your top customers:

| Metric | Description | Color coding |

|---|---|---|

| Top 1 Customer | Percentage of total MRR from your single largest customer | Green: <15%, Yellow: 15-30%, Red: >30% |

| Top 5 Customers | Cumulative percentage of total MRR from your top 5 customers | Green: <30%, Yellow: 30-50%, Red: >50% |

| Top 10 Customers | Cumulative percentage of total MRR from your top 10 customers | Green: <40%, Yellow: 40-60%, Red: >60% |

The color-coded indicators provide an at-a-glance health check:

- Green indicates healthy diversification

- Yellow suggests moderate concentration worth monitoring

- Red signals high dependency risk that may require attention

Pareto chart

The Pareto chart (also known as a cumulative distribution chart) shows how your MRR accumulates across customer ranks. Each bar represents the cumulative MRR up to that customer rank:

- Individual bars (#1 through #10) – Your top 10 customers shown individually

- Grouped bars (11-20, 21-50, 51-100, 101+) – Remaining customers grouped by rank ranges

This visualization helps you quickly see how much of your revenue is generated by your top customers versus the long tail of smaller accounts.

Pie chart

The pie chart provides a visual breakdown of MRR distribution across customer segments:

- Top 1 – Your single largest customer

- Top 5 – Cumulative from your top 5 customers

- Top 10 – Cumulative from your top 10 customers

- Top 100 – Cumulative from your top 100 customers

- Rest – All remaining customers

Hover over any segment or legend item to highlight that portion and see the exact percentage in the center of the chart.

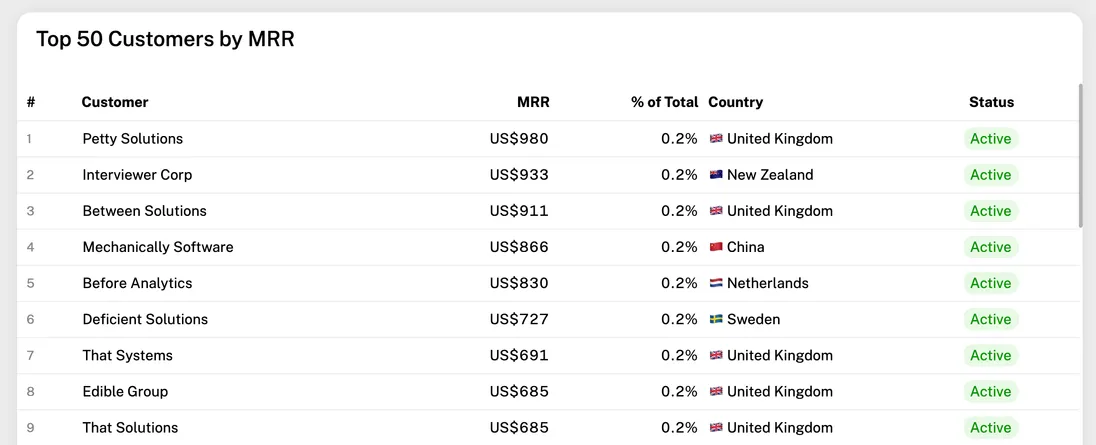

Top 50 customers table

The table lists your top 50 customers ranked by MRR, showing:

| Column | Description |

|---|---|

| # | Customer rank by MRR |

| Customer | Customer name or email (clickable link to customer detail page) |

| MRR | Monthly recurring revenue from this customer |

| % of Total | This customer's share of your total MRR |

| Country | Customer's country (with flag) |

| Status | Subscription status (Active, Trialing, etc.) |

Click any customer name to navigate to their detailed customer page.

Filters

The report supports filters to help you analyze concentration within specific segments:

Currency – Select your reporting currency. MRR values are converted using daily historical exchange rates.

Additional filters – region/country, main currency, industry, customer age, company size, acquisition channel, data source, and custom variables (see all filters)

Filters are applied to all sections of the report simultaneously, allowing you to see concentration metrics for specific customer segments.

Note: Unlike most other reports, Customer Concentration does not include a date range filter. This is because concentration is calculated based on current MRR values, representing a snapshot of your business today rather than a historical trend.

Exporting the data

You can export the top 50 customers table as a CSV file for offline analysis by clicking the download icon in the header. The export includes:

- Rank

- Customer name and email

- MRR amount

- Percentage of total

- Country

- Status

Understanding concentration risk

Customer concentration is a key indicator of business health and risk:

Why concentration matters

- Revenue stability – If a top customer churns, high concentration means a significant revenue impact

- Negotiation power – Large customers may demand discounts or special treatment

- Investor concerns – VCs and acquirers often scrutinize customer concentration as a risk factor

- Growth sustainability – Healthy businesses typically have diversified revenue streams

Industry benchmarks

While ideal concentration varies by business model and stage, general guidelines suggest:

| Metric | Healthy | Moderate Risk | High Risk |

|---|---|---|---|

| Top 1 customer | <10% | 10-25% | >25% |

| Top 5 customers | <25% | 25-40% | >40% |

| Top 10 customers | <35% | 35-50% | >50% |

Early-stage companies often have higher concentration that decreases as they scale and diversify their customer base.

Practical tips

Monitor trends over time: While this report shows current concentration, track these metrics monthly to see if you're becoming more or less concentrated as you grow.

Segment your analysis: Use filters to check concentration within specific regions or industries. You may find healthy overall concentration but dangerous concentration in a specific segment.

Plan for whale risk: If your Top 1 customer represents >20% of MRR, develop a proactive retention strategy for that account and work to diversify by acquiring more mid-market customers.

Use for pricing strategy: High concentration often indicates opportunity to move upmarket. Consider whether your pricing supports acquiring more enterprise customers while maintaining a healthy SMB base.

Investor preparation: If preparing for fundraising or acquisition, aim to reduce Top 10 concentration below 40%. Investors view high concentration as execution risk.