LTV

The LTV (customer lifetime value) report estimates the total revenue a typical customer will generate over their entire lifespan as a paying subscriber. It is one of the most important high-level SaaS metrics in GrowPanel, as it is the foundation for calculating the critical LTV:CAC (Lifetime Value to Customer Acquisition Cost) ratio.

LTV is calculated by taking the Average Revenue Per Account (ARPA) and dividing it by the Logo Churn Rate (LCR) averaged over the past six months.

Note on Simplification: This formula represents a simplified, common industry convention. It assumes a flat churn rate for all customers, regardless of their plan or tenure. In reality, long-time customers often have lower churn rates than new ones. While simplified, this LTV calculation remains a powerful and consistent benchmark for tracking the value of your average customer over time.

For an in-depth explanation of LTV as a metric, see the LTV guide in the SaaS Metrics Academy.

Overview

The LTV report includes a timeline chart and a breakdown table. Since LTV is derived from two other calculated metrics (ARPA and Logo Churn Rate), the table cells are not clickable and there is no detail table.

Timeline chart

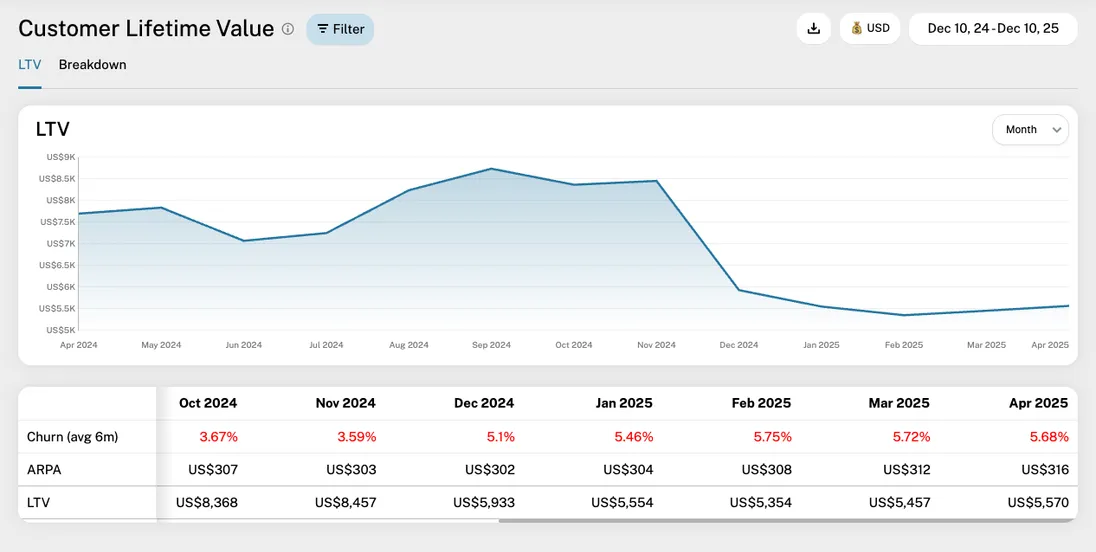

The timeline chart shows your calculated LTV over the selected period. If you hover the chart, you'll see a tooltip displaying the underlying components: the ARPA and the Average 6-Month Logo Churn Rate used in the calculation for that specific period. The currently ongoing period is marked as a dashed line.

The LTV line helps you track the strategic impact of changes to your pricing (which affects ARPA) and your retention efforts (which affects Churn Rate).

Breakdown table

The table underneath the chart displays the three core components used to calculate LTV for each period.

| Metric | Description |

|---|---|

| Churn (avg 6m) (Red) | The Logo Churn Rate averaged over the preceding six monthly periods. This smoothed figure is used in the LTV formula to reduce volatility. |

| ARPA | The Average Revenue Per Account (MRR / Subscribers) for the period. |

| LTV | The calculated Customer Lifetime Value (ARPA / Avg. 6-Month Churn Rate). |

The churn rate is typically shown in red as it represents customer loss, while LTV is an important financial output, displayed as an amount.

Filters

The report supports a wide range of filters to help you analyze LTV within specific segments of your business. These include:

Date range

Select a custom range or preset periods (last 30 days, last quarter, etc.)

Interval

Choose how LTV is aggregated: daily, weekly, monthly, quarterly, or yearly.

Currency Select your reporting currency. This affects the ARPA and the resulting LTV. When switching reporting currency, the reports are calculated on the fly using daily historical exchange rates. If you want to fix/freeze FX rates in your reports, you can tick a checkbox, and all FX rates are fixed at the start date of the report.

Additional filters – plan, region/country, acquisition channel, etc. (see all filters)

Filters are applied to both the chart and the table simultaneously.

Exporting the data

You can export the table as a CSV file for offline analysis or reporting by clicking the "Export" icon next to the date picker.

Practical tips

- Segmentation is Essential: Use Additional filters to calculate LTV based on the customer's acquisition channel or initial product plan. This allows you to allocate marketing budget effectively toward channels that bring in the highest value customers.

- The LTV:CAC Ratio: Use the LTV data here to determine your LTV:CAC ratio. A ratio of 3:1 or higher is often considered healthy for a SaaS business, meaning the customer brings in three times the revenue it cost to acquire them.

- Impact of Changes: Look for upward trends in LTV. An increase is typically the result of either increasing prices (higher ARPA) or improving retention (lower Churn Rate).